Card machines for small businesses

The UK is a nation of card lovers. In 2017, for the first time, card transactions overtook cash as the most common form of payment.

Customers and clients increasingly expect to be able to pay on card for the goods and services they buy, whether they are dealing with a small, medium or large business.

That means that it's important for small businesses to look into the ways they can cater for card payments if they aren't already doing so.

While we're a long way from being a cashless society, businesses need to try to deliver a user experience that their customers appreciate.

Our guide looks at what small businesses need to know about credit card machines.

Things to do before you purchase a credit card machine for your business

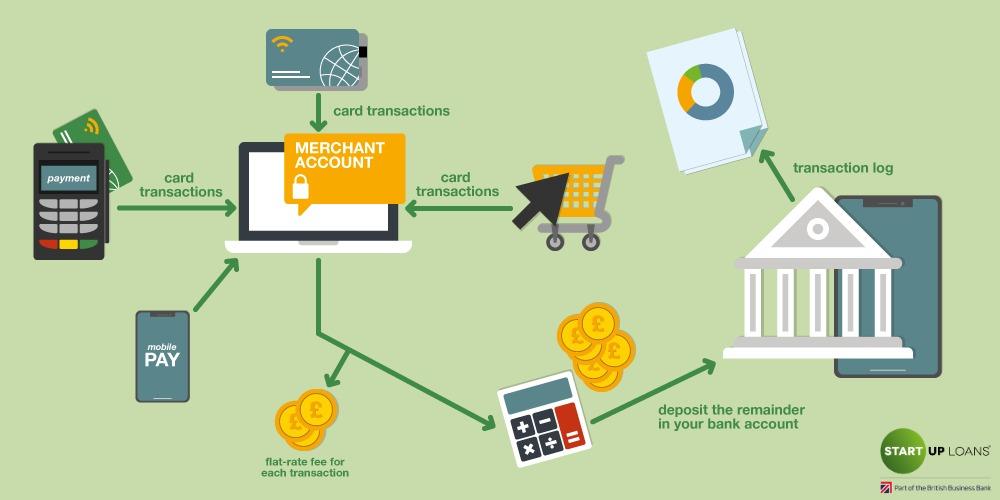

There are a couple of things you need to get in place before you can start accepting card transactions – these include a merchant account and a payment gateway.

Merchant account

Distinct from your business bank account, a merchant account is a type of bank account that your customers' payments are transferred to while awaiting authorization from your payment gateway.

Once that authorisation is received, the money then passes to your business bank account.

A number of banks offer merchant accounts (these are known as acquiring banks), these are:

- Bank of Ireland (through Elavon)

- Barclays (through Barclaycard Merchant Service)

- Clydesdale Bank

- HSBC (through Global Payments)

- Lloyds

- NatWest (through WorldPay)

- Royal Bank of Scotland (through WorldPay)

- Santander (through Elavon)

- The Cooperative Bank

- Yorkshire Bank

- American Express

- Elavon

- First Data Merchant Solutions

- WorldPay

Payment gateway

As well as a merchant account, you'll need a payment gateway. This is an online service that checks for potential issues with a payment before authorising it.

Most merchant account providers will be able to provide you with a payment gateway as well.

It's worth noting that it can take anywhere between 24 hours and 3 days for payments taken by card to reach your business bank account, depending on the speed of your merchant account provider as well as the time taken for your payment gateway to authorize the payment.

Types of small business card machines

When you have a merchant account and payment gateway in place, you need to invest in one or more card machines to take payments.

There are a number of different types of machines, sometimes called PDQs (process data quickly) to consider.

Fixed card machines

Many businesses have a fixed card machine in place on a counter, next to their till or front desk.

This connects to your merchant account, often via a telephone line, and allows customers to insert or tap their cards to make payments.

Portable card machines

It's not always convenient to have your card machines tied to one fixed spot, especially if you run a restaurant, café or bar, for example.

In this instance, portable machines – which connect via WiFi or Bluetooth – can allow you to take your machine to the place where it's easiest for the payment to be made.

Mobile card machines

Businesses can also buy card machines that will work when out and about.

Mobile card machines work either by connecting to a smart phone or connecting to a phone network using a SIM card.

Card machines that connect to your smart phone are usually more competitively priced compared to SIM based machines, and often work on a pay as you go basis, meaning you're not tied into a lengthy contract.

Mobile card machines are often favoured by people who travel to clients and need to have an on-the-go payment option.

Accepting contactless payments

While card payments are popular, the biggest growth has come in the number of people using contactless payments.

It makes sense to shop around for a card machine that can accept such payments, especially if yours is a business that processes a lot of payments under £30 (the current upper limit for contactless payments).

Other things to consider with your small business card machine

As well as the type of machine, there are a number of other factors to consider when buying your machine. These include:

- Battery life – Ideally, your machine should be able to last for a significant amount of time without the need for recharging. Ask how many hours the machine you are considering can last on one charge. How many transactions can typically be processed?

- Connectivity – Do you want to connect with Bluetooth, WiFi, mobile network or Ethernet – Make sure your machine can handle the connection you wish to use.

- Compatibility – How will your machine fit into your existing system? Will all transactions be logged directly in your sales software or do you need a new app/program?

- Receipts – Can your machine print receipts for your customers, or perhaps email them a receipt?

Costs

Fees will be significant factor when choosing card machine, merchant account and payment gateway providers.

Card machine purchase

The cost of a card machine will vary depending on the type of card machine you are looking for, and whether you choose to rent or buy outright.

Renting a card machine will typically cost between £18 and £30 per month, for the duration of your contract, with portable machines costing the most.

A more flexible option is a one-off purchase of a mobile card reader that works with a mobile phone. These card readers can cost from as little as £30 up to £80.

It's also worth looking out for promotional deals from some of the new card machine providers looking to bring in new customers.

Merchant fees

On top of renting or buying your card machine, you'll need to consider the fees that your provider will charge on every transaction you process, often called Merchant Service Charges.

These fees are charged by your merchant account provider and can vary dramatically depending on a number of different factors: type of card machine, volume of transactions, ratio of debit card to credit card or commercial card transactions, average payment size, and how many non-European card payments you accept.

Typically, you'd expect to pay higher fees if you have lower volumes. Using a mobile card reader that connects to your phone will often have the highest fees as they operate on a pay-as-you-go model.

Credit cards and non-European card transactions will usually incur higher fees.

Whilst it's hard to say what sort of fees you should look for, you can expect fees for face-to-face card payment to range from:

- Debit Cards – 0.25% to 0.35%

- Consumer Credit Card – 0.7% to 0.9%

- Commercial Credit Card – 1.6% to 1.8%

Authorization fees

This charge covers the authorization your payment gateway must provide for each successful transaction. Charged at a fixed rate per transaction, this fee is generally between 1p and 4p.

Though some of the new business offering mobile card readers will combine this charge with the merchant fee, paid as a percentage of a transactions value.

Setup fee

Many providers will charge a setup fee for the delivery and set up of the card machine, which can be around £100.

Mobile card machine providers do not usually charge a set up fee, but will require you to do the initial set up once you receive the card machine.

Minimum billing charge

Some providers will charge you a minimum fee if the fees you are paying on card transactions within a given month fall below an agreed minimum, typically set around £20.

Many of the newer mobile card readers do not have minimum billings, and instead operate on a pay-as-you-go model.

Chargeback fees

A chargeback is when a customer requests a refund through their debit or credit card provider, for whatever reason, your payment provider will need to handle the refund request.

This may involve having to collate evidence from both the customer's bank and from you, to understand why the refund is being requested.

Some providers will charge a fixed rate of around £10 for any chargebacks, others will only charge for successful chargebacks (where you refund the customer).

Data protection and PCI compliance

The Payment Card Industry Data Security Standard (PCI DSS) is a set of standards designed to make sure that all companies who accept or process credit card information, no matter how small, do so in a secure environment.

For a small or medium sized business, chances are you will simply be paying to use a payments system entirely managed by a payment provider.

This is good, because most payment providers will guarantee that they meet PCI DSS standards, but it is up to you to check that they do.

One place to be careful is if you collect orders online or through an app as this may involve collecting data outside of the payments system.

Similarly, if you take orders over the phone, and record customer calls, you may well be inadvertently storing customer payment information outside of the payment system.

Virtual and online card payments

We've not talked about virtual card machines and online payments in this article.

Virtual card machines are used to take card payments over the phone and are perfect for call centers or retailers who do a lot of business over the phone.

Online payments allow you to take payments through your website, whilst providing a secure platform for users to safely enter their payment details.

Most card payment providers will bundle together face-to-face packages with online and virtual card payment packages. Bear in mind however that you can expect to pay much higher fees as a % of each transaction.

Disclaimer: The Start -Up Loans Company makes reasonable efforts to keep the content of this article up to date, but we do not guarantee or warrant (implied or otherwise) that it is current, accurate or complete. This article is intended for general information purposes only and does not constitute advice of any kind, including legal, financial, tax or other professional advice. You should always seek professional or specialist advice or support before doing anything on the basis of the content of this article.

The Start-Up Loans Company is not liable for any loss or damage (foreseeable or not) that may come from relying on this article, whether as a result of our negligence, breach of contract or otherwise. “Loss” includes (but is not limited to) any direct, indirect or consequential loss, loss of income, revenue, benefits, profits, opportunity, anticipated savings, or data. We do not exclude liability for any liability which cannot be excluded or limited under English law. Reference to any person, organisation, business, or event does not constitute an endorsement or recommendation from The Start-Up Loans Company, its parent company British Business Bank plc, or the UK Government.

Your previously read articles

Sign up for our newsletter

Just add your details to receive updates and news from Start Up Loans

Sign up to our newsletter