South West milestone

Press release

Start Up Loans celebrates £250 million of loans to businesses in Western England.

- Since launching in 2012, Start Up Loans has delivered over 29,000 loans worth more than £266 million, to businesses in the North West, West Midlands and South West with the average loan being £9,440

- Counties across the South West receiving the most funding since 2012 include Devon and Cornwall (including the Isles of Scilly)

- 8,495 loans drawn down by recipients in Western England since 1 April 2020 totalling £100 million

- 38% of the total value of loans in the South West delivered since the pandemic began

Start Up Loans, part of the British Business Bank, announces that the programme has delivered 29,088 loans worth more than £266 million to businesses in Western England. The figures point to the spirit of entrepreneurship across the Western counties of the country.

The South West has received over £78 million (8,543 loans) since 2012, while the North West has received more than £112 million (12,314 loans) and the West Midlands has received over £76 million (8,231 loans).

Of these loans, 2,551 amounting to more than £29 million were drawn down in the region since the pandemic began; this equates to 38% of the total value of loans delivered over the lifetime of the programme.

Impressive figures for entrepreneurship during the pandemic show how people have been helped by Start Up Loans to launch their own businesses when conditions in the job market were difficult.

| UK Region | Loans Made | Amount Lent (£) | Average Loan Amount (£) |

|---|---|---|---|

| North West | 12,314 | 112,100,733 | 9,350 |

| South West | 8,543 | 78,441,686 | 9,112 |

| West Midlands | 8,231 | 76,125,191 | 9,897 |

| Total | 29,088 | 266,667,610 | 9,440 |

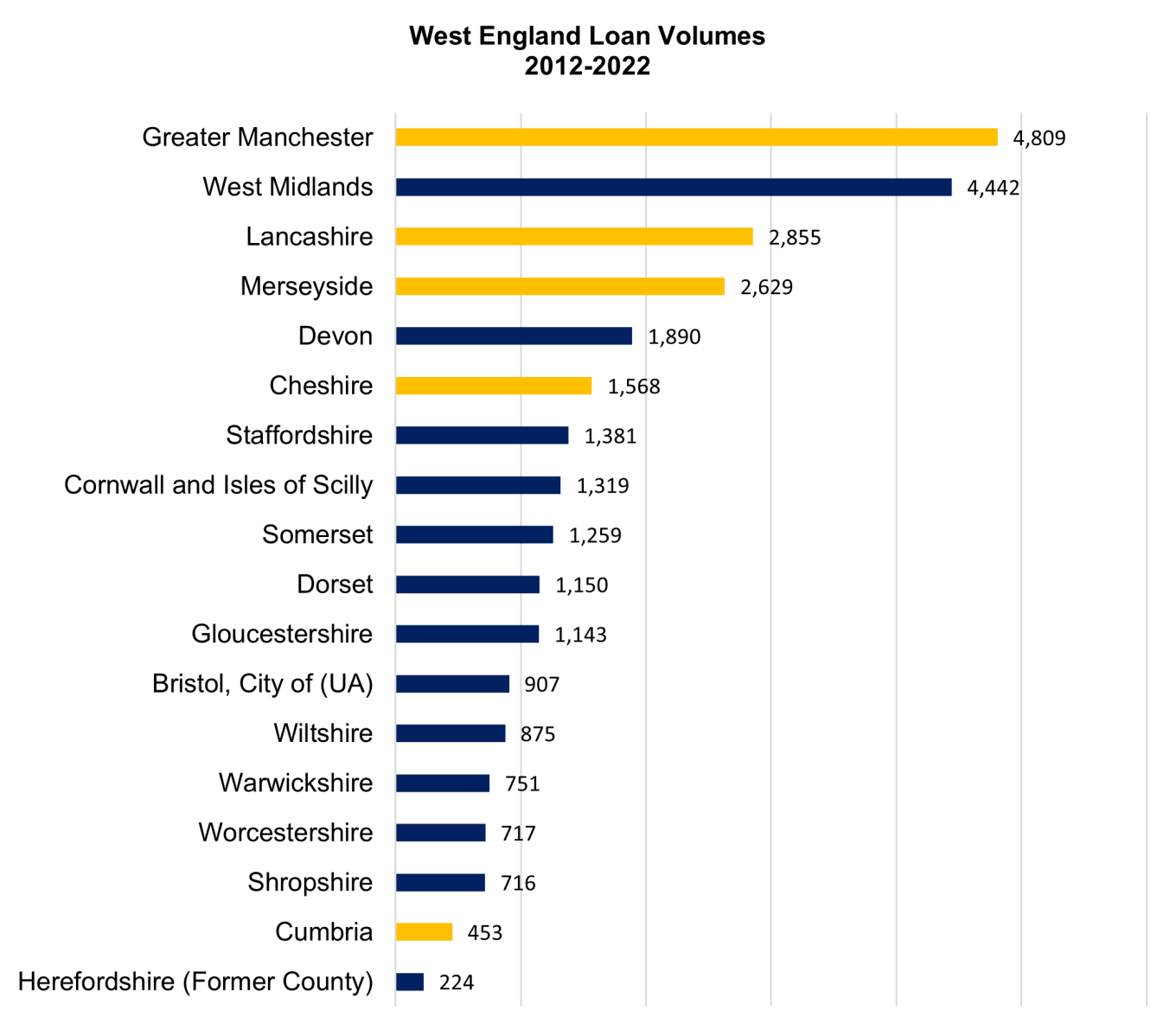

Listed in the below table are the counties throughout the West to receive the most loans since 2012. Top counties across the South West include Devon, which received more than £18 million in funding, and Cornwall (including the Isles of Scilly) which received over £13 million in funding.

Of the total 29,088 loans in Western regions, 39% have been to women and 14% to people from Black, Asian and Other Ethnic Minority backgrounds (not including White Minorities). Young people between 18-24 years old have received 14% of the loans in the West since 2012, and 30% of the total loans made to people in the same age bracket nationally since the programme began in 2012.

If we are to unlock economic growth, we need to remove the barriers faced by the UK’s most innovative entrepreneurs when it comes to accessing funding and growing their business. Backed by more than 8,543 loans worth more than £78.4m our most dynamic small businesses across the South West have been able to tap into government support to flourish and fast-track their business ideas and innovations to market. - Kevin Hollinrake Small Business Minister

It’s a testament to the entrepreneurial spirit of the South West that we’re celebrating such a significant milestone, well over a quarter of a billion pounds, invested across the Western regions since 2012. I am particularly proud of the fact that we have been able to support such a huge volume of young aspiring business people and their start up ventures in the West, which represents 30% of the total across the entire of the UK. - Steve Conibear UK Network Director – South and East of England

The business community in the South West is going from strength to strength. As one of the Ambassadors for Start Up Loans, I am grateful to be in a position to inspire and support other aspiring business owners. Having a strong local business network and information that is easily accessible, are vital for making that first step into business ownership. The figures show that more and more entrepreneurs are taking the plunge, which is testament to the business community we have here. I would urge anyone thinking about starting their own venture to go for it in the New Year. - Hannah Saunders Owner, Toddle Born Wild, Newent, South West

| UK Region | County | Loans Made | Amount Lent (£) | Average Loan Amount (£) |

|---|---|---|---|---|

| North West | Greater Manchester | 4,809 | 46,006,192 | 9,567 |

| West Midlands | West Midlands | 4,442 | 38,191,835 | 8,598 |

| North West | Lancashire | 2,855 | 23,475,569 | 8,223 |

| North West | Merseyside | 2,629 | 22,110,675 | 8,410 |

| South West | Devon | 1,890 | 18,049,201 | 9,550 |

| North West | Cheshire | 1,568 | 15,747,658 | 10,043 |

| South West | Cornwall and Isles of Scilly | 1,319 | 13,280,544 | 10,069 |

| West Midlands | Staffordshire | 1,381 | 13,123,469 | 9,503 |

| South West | Dorset | 1,150 | 11,127,171 | 9,676 |

| South West | Gloucestershire | 1,143 | 10,453,500 | 9,146 |

| South West | Somerset | 1,259 | 10,242,387 | 8,135 |

| South West | Wiltshire | 875 | 8,743,698 | 9,993 |

| West Midlands | Warwickshire | 751 | 8,139,179 | 10,838 |

| West Midlands | Worcestershire | 717 | 7,416,017 | 10,343 |

| West Midlands | Shropshire | 716 | 6,916,596 | 9,660 |

| South West | Bristol, City of (UA) | 907 | 6,545,185 | 7,216 |

| North West | Cumbria | 453 | 4,760,640 | 10,509 |

| West Midlands | Herefordshire (Former County) | 224 | 2,338,095 | 10,438 |

| Total | 29,088 | 266,667,610 | 9,440 |

Notes to editors

About Start Up Loans

The Start Up Loans programme provides personal loans for business purposes of up to £25,000 at a 6% fixed interest rate per annum and offers free dedicated mentoring and support to each business.

The primary aim of the Start Up Loans programme is to ensure that viable start-ups and early-stage businesses have access to the finance and support they need in order to thrive. A network of Delivery Partner organisations supports applicants in all regions and industries throughout the UK. The Start Up Loans programme is not designed to generate a commercial profit. Capital payments together with the interest are recycled to help meet our customers’ increasing demands for finance.

Free guides on a range of subjects related to starting a business and recent media press releases are available on the Start Up Loans website.

The funding for the Start Up Loans programme is provided by the Department for Business, Energy and Industrial Strategy (BEIS). A development bank wholly government-owned by BEIS, the British Business Bank plc is not authorised or regulated by the Prudential Regulation Authority (PRA) or the Financial Conduct Authority (FCA). The British Business Bank and its subsidiary entities are not banking institutions and do not operate as such.

The British Business Bank makes finance markets for smaller businesses work better, helping the sector to prosper, to grow and to build economic activity.

Key Statistics

- Since its inception in 2012, the Start Up Loans scheme has delivered almost 99,800 loans, providing more than £934 million of funding.

- In the financial year 2021/22, the scheme provided 12,433 loans with a total value of approximately £152.4 million

- The economic benefits of the Start Up Loans programme are almost six (5.7) times its economic costs.

- At Spending Review 2021, the Chancellor announced resources to provide 33,000 Start Up Loans over next three years.

Aside from the return-on-investment numbers these statistics are gross estimates and based on Start Up Loans CRM along with externally commissioned research undertaken by SQW Ltd, with support from BMG Research. Since 2012, 5% of loans went to people formerly unemployed or economically inactive. Some 40% of loan recipients were women and 21% were from Black, Asian and Other Ethnic Minority backgrounds (not including White Minorities).

Quick links

Latest news

-

Read more about Backing the Next Generation of Entrepreneurs Press release

29 January 2026 -

Read more about Demand for start up finance suggests a continued entrepreneurial drive Press release

20 January 2026 -

Read more about Founders in London take out £250m of Start Up Loans, with Hackney the most entrepreneurial borough followed by Lambeth and Lewisham Press release

12 January 2026